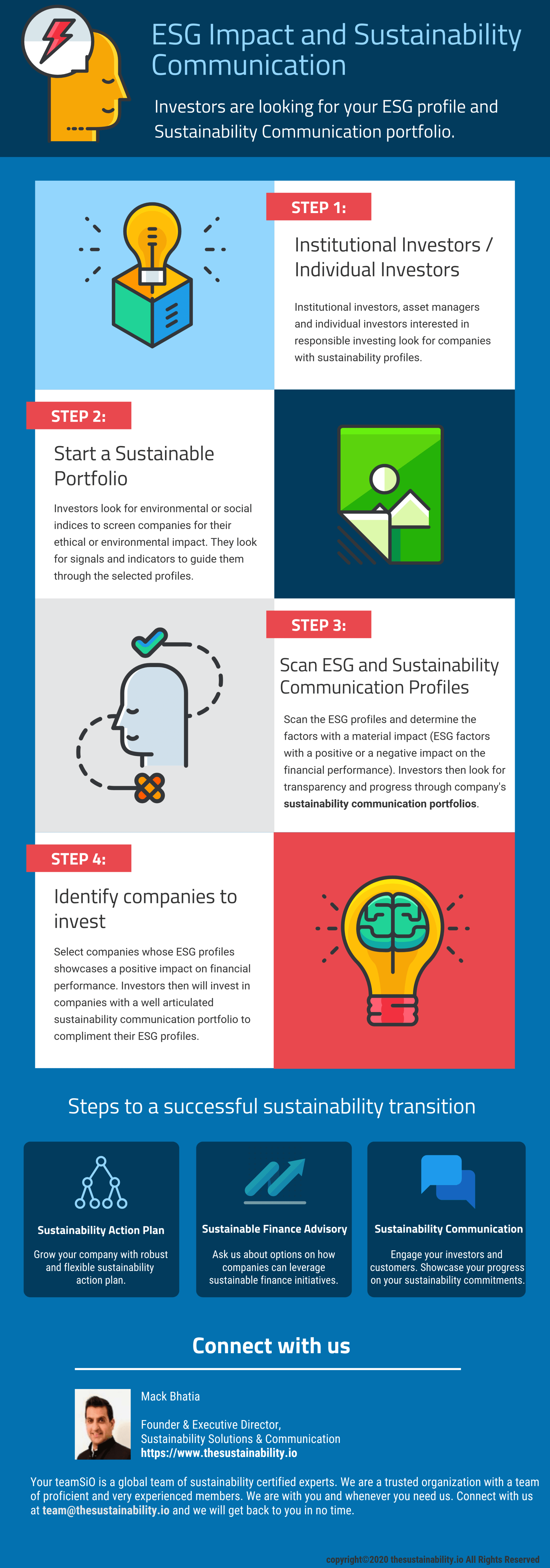

ESG Impact and Sustainability Communication

MACK BHATIA

Engage your investors with sustainability communication on your ESG improvements

What is ESG

Environmental, Social and Governance (ESG) factors or criteria are a set of strategic and operational standards followed by a company which has a potential impact on environment or society. In other words, it is a framework for assessing the impact of the sustainability and ethical practices of a company.

While the environmental factor (E) is primarily concerned with the company’s influence on the environment and its ability to mitigate various risks that could harm the environment, the social factor (S) investigates the company’s relationships with other businesses and communities. Governance (G) is concerned with the internal company’s affairs and the relationships with the main company’s stakeholders, including its employees and the shareholders.

Investors look towards these ESG factors to make their investment decisions. The ESG criteria also helps determine the financial and future performance of the companies ( in terms of both returns and risks ). This investment decision making practice commonly known as responsible investing, is followed by numerous asset owners and asset managers moving towards making sustainability as a new standard of investing. BlackRock, as an example have already taken significant steps towards to make sustainable investing as a key part of their investment strategy.

Sustainable Investing and ESG Integration

Sustainable investing is about investing in the progress of the companies who are focused (in a way) to solve the existing environmental or social challenges. The approach is to identify those companies who are making significant efforts to pioneer ways in their operational, product or business strategies and address challenges such as climate change or other social issues. Investors now recognize that these companies are positioned to grow in a longer term.

The growth in sustainable investing is largely driven by financial decision makers, regulators and governments incorporating sustainability into their investment information and into the decision making process. These financial decision makers are motivated by the

Six Principles of Responsible Investment (PRI) which were formulated by United Nations.

The PRIs addresses the current challenges were developed by the investors and for the investors in order to incorporate sustainability into the financial ecosystem and investment decision making process.

About ESG Integration

ESG Integration is the practice to incorporate ESG information into the investment decisions. Looking at it another way - ESG integration and the ESG components helps investors analyze the material factors to make informed investment decisions. Among the most important reasons to integrate ESG factors in the sustainable portfolio, the following two are the most valuable:

- Risk, returns and opportunities: ESG factors are considered to be an important parameter to measure company's long term performance. Investors incorporate ESG factors to lower their risk or to generate better returns. Primarily, investors turn to ESG factors to attempt and avoid risk in an individual company or a sector.

- Materiality: Materiality is another key component of ESG integration. It primarily involves giving more importance to ESG issues or the ESG factors which are likely to affect a corporate's financial performance. Financially material ESG factors have a significant impact (positive or negative) on a company’s business model, revenue growth, cash, margins or other forms of capital.

How do investors understand the ESG Factors?

Practitioners and analysts study ESG factors using the ESG data available for a company or an organization. Investors can access this data through varied ESG data service providers or through any sustainability communication materials. They analyze this data to try identify the ESG factors with a potential material impact on the company and forecast any risks and opportunities.

Investors can also look if any of the companies in the portfolio have any ESG scores available publicly or through any rating agencies. ESG rating agencies do a deep research using varied methodologies and then score companies based on a set criteria. Investors either trust ESG data and ESG Ratings or embed this ESG data into their own tools for further analysis.

Corporates can also get their own scores through the rating agencies. This can give corporates a more in-depth view of how they are perceived in the market. They can look into the ESG parameters that investors are most interested in. There is a huge opportunity for corporates to showcase their ESG score or identify opportunities of improvements in their ESG factors. This message should be part of any sustainability (ESG) communication materials developed by corporates and companies. Read more on mapping sustainability communication with respective stakeholders.

Adding ESG improvements and ESG impact in their sustainability communication profile develops trust and transparency among investors and other stakeholders.

ESG and Sustainability communication

Institutional and individual investors look for signals to help them make better investment decisions and reduce their risk with their sustainable portfolios. Investors will also want to strengthen their reputation on sustainable investment. The most important component of ESG communication is how you drive business value with ESG and sustainability.

Analysts and practitioners collate the ESG information from various sources which includes company reports, filings and any publicly available information through information on corporate websites, reports, videos, interviews, and other communication materials. They then refer and assess through this list of available information to periodically review the ESG impact and materiality impacts.

Regular communication on how you address ESG issues and your progress towards the sustainability commitments is a critical factor in influencing the investment decisions. Moreover it is very important to maintain the reputation of the company. Stock prices depends, or at-least in part, on companies impact on environment and society.

Showcasing our ESG impact or your progress towards your sustainability commitments influences the sentiment among the shareholders and builds upon your reputation. Hence, sustainability communication is no doubt the most important component of a sustainability strategy.

Reach out to us

Private equity firms are required to have an ESG strategy which is aligned to the limited partner’s ESG focus. Private equity industry is under greater scrutiny than ever before, and PE firms must do a better job of capturing and tracking the value they are creating and the impact of their activities.

SIOChain - Supply chain sustainability management system positions you stronger growth working closely with suppliers or partners to manage your environmental and social impact. Through supplier engagement, supplier recognition, and sustainable procurement, you can manage risks while increasing productivity and efficiency within the value chain

Our team provides services and due diligence to not only identify ESG opportunities but help our clients quantify potential ESG benefits and risks, incorporate ESG policies into the strategies and activities, facilitate transactions between asset buyers and sellers, and provide confidence among all parties that ESG commitments are made, and risks are managed.

It is very important that companies make sustainability and ESG a central component of their business model. “We know that climate risk is investment risk. But we also believe the climate transition presents a historic investment opportunity”, says Lary Fink from BlackRock. Authoritative statements like these present an opportunity for companies to prepare their business and our economy against the greatest global threats while it opens doors for capital access.

It is imperative to activate ESG and sustainability through the supply chain to develop transparency and visibility on ESG and sustainability practices. Companies need to collaborate with their suppliers and supply chain participants in upstream and downstream operations in order to meet their environmental and sustainability commitments. See more.

Effective communication with sustainable investors focused on your ESG progress is an important component of your ESG strategy. It fills the gap between investor expectations and your sustainability

or ESG strategy.Sustainability and ESG communication is an approach to engage your customers and

investors, and to showcase your ESG progress and sustainability commitments.

It is imperative to focus on supply chain sustainability in order to meet your sustainability commitments and meet your environmental targets. SIOChain™, a technology platform is designed to engage your suppliers and collaborate to measure, monitor and embed sustainability and ESG in your supply chain.

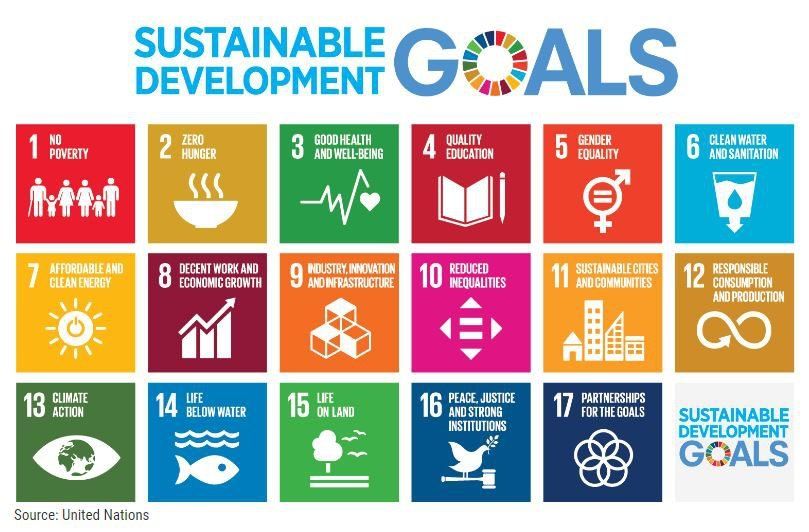

The purpose of sustainable financing, as stated by the UN Environment Programme , is to increase the level of financial flows (from banking, micro-credit, insurance and investment) from the public, private and not-for-profit sectors to sustainable development priorities. The aim is to align financial systems, working with countries, financial regulators and financial sectors, and direct capital allocation to sustainable development that will shape the production and consumption patterns of tomorrow. Financial mechanisms such as Green Bonds, Social Bonds and ESG Linked Loans help this alignment as they promote public-private partnerships for sustainable development. The Sustainable Development Goals (SDGs) are a collection of 17 global goals set by the United Nations General Assembly as an agenda for the year 2030. These 17 SDGs are an urgent call for action by developing and developed countries and provide a blueprint for the peace and prosperity for people and the planet. The SDGs also recognize issues related to the planet, such as biodiversity, and to people, such as poverty, and accept that solutions to address all of these issues are interconnected. Green Finance (or Sustainable Finance) instruments such as Green Bonds, and bonds focused on other thematic issues such as Social Bonds, Sustainability Bonds or Sustainable Development Goal Bonds, can act as a strong bridge to the SDGs. Such initiatives allow the flow of capital to execute and meet corporate sustainability commitments. They are also attractive to institutional investors as they perceive financial commitments to sustainability as a good indicator of a corporation's ESG progress. Related: More about Social Bonds