Supply Chain Sustainability – Activate ESG and Sustainability through the supply chain

MACK BHATIA

Activate supply chain sustainability and ESG in your upstream and downstream activities

In recent years a rising number of multinational corporations have pledged to work only with suppliers that adhere to the respective Environmental and Social standards or practices. This pledge largely comes from the companies who are committed to a transition to sustainable practices, or who have ESG (environmental, social and governance) as part of their business strategy.

Many times, the sustainability commitments include working with sustainable suppliers, sustainable procurement practices, or to identify baseline metrics such as emissions, use pf plastics, waste produced through their supply chain – so they can improve upon it. This, when supply chain sustainability is essential to meet sustainability targets, or when supply chain sustainability is inseparable from ESG integration practices. However, like any new initiative, supply chain sustainability comes with certain challenges.

Current challenges and opportunities

Application of sustainable practices through the supply-chain presents certain challenges and opportunities:

Delivery on ESG commitments: when value is created for all stakeholders: Sustainable businesses are redefining the corporate ecosystem by designing models that create value for all stakeholders, including employees, shareholders, supply chains, civil society, and the planet (creating a shared value). Initiatives like supply chain sustainability can include many internal and external stakeholders. It is important to get stakeholder alignment on these new models which can delay the delivery of sustainability / ESG commitments.

Demands in the Supply Chain:

Huge demands from customers to innovate supply chains and find solutions to meet strategic objectives and customer needs becomes a challenge in times when suppliers are encouraged to focus on producing more and are required to deliver on the business needs. Companies and suppliers can find opportunities to balance between production, delivery times and sustainable practices through collaboration and planning.

Risks in Supply Chain creates pressure difficult to manage:

Supply chains are complex operations and at times susceptible to risks posed from political and government changes, procurement practices, information theft - to name a few. Such external forces and customer demands creates a pressure on many companies, entire industries. It can force companies to rethink and transform their global supply chain model. Hence such priorities can push supply chain sustainability on the back burner.

Creating transparency for customers:

Business now look for sustainability and ESG transparency primarily driven by ESG disclosure demands from investors, and expectations from the end consumer. This is a challenging task as it requires that companies and corporation incorporate processes, install ESG measurement tools, and activate processes to gather ESG data and other tools to collaborate with all supply chain participants.

Collaboration tools to engage with customers:

Supply chain participants are looking for better tools to collaborate and meet sustainability and ESG expectations. This, which should not hamper the existing process or without overloading the supply chain operational process. These tools are not very readily available, and, in many cases, companies need the support of internal technology teams to develop them. This is not a very easy task as companies and internal teams may have to prioritize the development of other tools over other priorities, which needs buy-ins, business case approvals and more.

Engaging with Tier 2's and onward:

The recent study by Harvard Business Review stated that the more risks comes lower down the supply chain. Business can engage with Tier 1 suppliers as they have stronger relationships and healthier opportunities to collaborate on any new initiatives, but finds it challenging to collaborate and engage with Tier 2 suppliers and beyond.

When issuers decide to issue a Green Bond or a Social Bond, the project framework must be built around the Green Bond Principles, Social Bond Principles or Sustainability Bond Guidelines. These principles and guidelines, developed by International Capital Market Association (ICMA), encourage issuer transparency and disclosure of the project's details including how the proceeds are intended to be used (use of proceeds), and the reporting process. As per the principles, the annual report should include the list and description of allocated projects and their expected impact.

Green competence in upstream and downstream operations

An important to activate supply chain sustainability is to assess green competence in the upstream and downstream operations. Challenges in supply chain management in upstream operations can creep into any part of the supply chain and create problems with ripple effects. While a focus to improve environmental, social, and governance (ESG) performance in the downstream operational areas requires hand-in-hand collaboration and trust.

Assessment, once complete can help companies identify key areas to optimize for its environmental and social impact. This can then help enable processes and design tools to get the baseline ESG metrics to improve upon. Such assessments can help emphasize how green practices can be adopted and identify operational areas with green opportunities. It can help mitigate environmental degradations from supply chain activities and increase the economic and operational performance. Hence, enablement of green supply chain can sustainable development strategy as a whole.

Expectations from suppliers on ESG initiatives

One of the important steps to activate ESG and Supply Chain sustainability is to get visibility and transparency through the supply chain. It is absolutely imperative to identify areas of biggest impacts, largest risks and to figure out opportunities for cost efficiency. To pursue this, companies do have certain expectations from the suppliers and supply chain participants, this is in alignment with their commitment to work with only those suppliers who adhere to the respective environmental and social standards. Important expectations from suppliers includes the following:

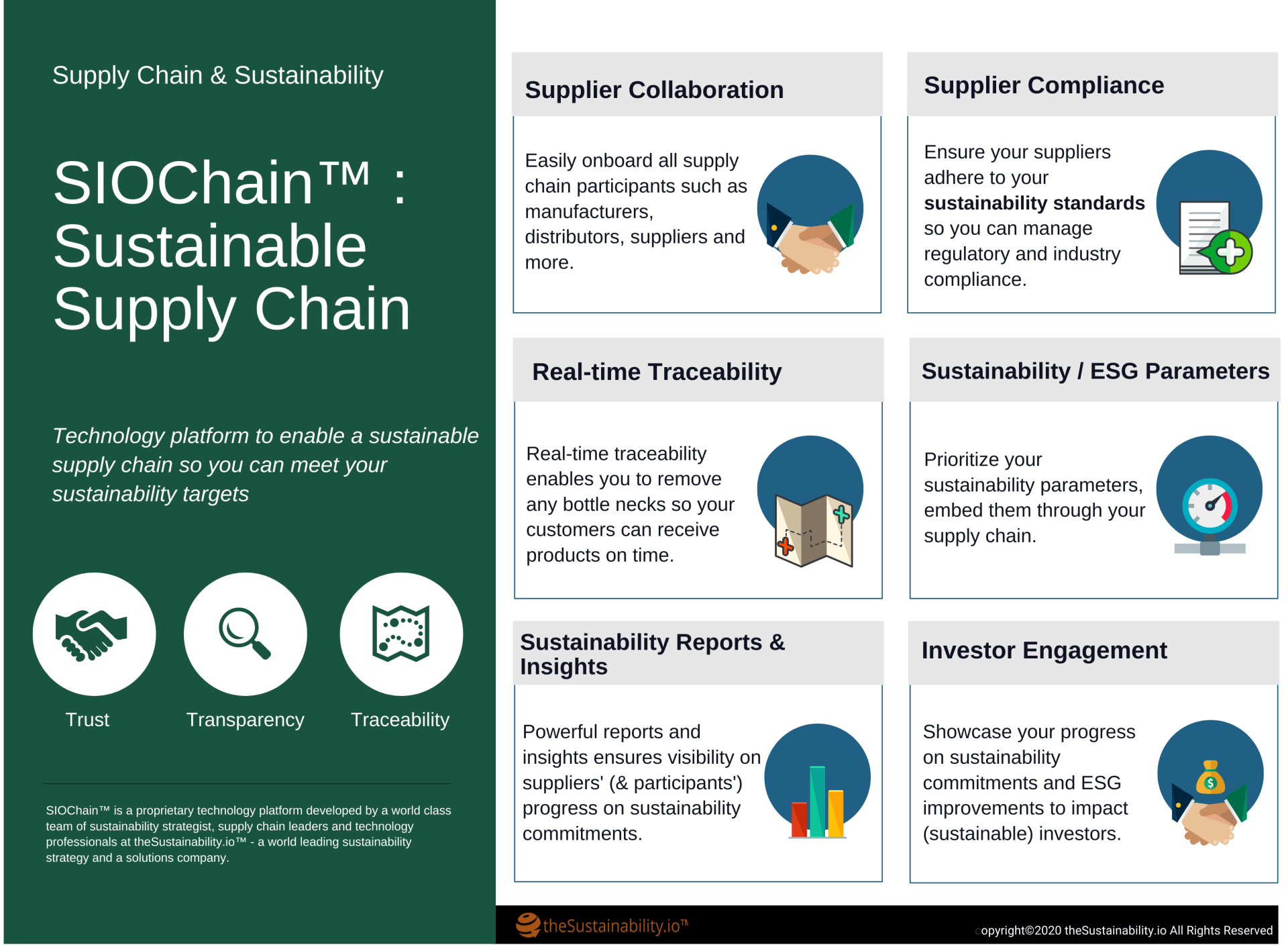

Supplier Collaboration:

A collaboration with suppliers and onboard all supply chain participants such as manufacturers, distributors, suppliers and more on ESG efforts.

Supplier Compliance:

To manage regulatory and industry compliance, it is expected that suppliers are compliant to industry best practices and that they adhere to Sustainability Standards set by companies they work with.

Traceability and visibility:

It are expected that suppliers join their customers to enable visibility and transparency in their operations – through processes or using tools and technology. Real-time traceability, for example, can help remove any bottlenecks through the delivery chain.

Sustainability / ESG Visibility:

In order to showcase ESG progress to investors and customers, it is important to prioritize ESG in the supply chain so the company can meet their environmental targets.

Opportunities for corporations and companies with sustainable suppliers

Supply chain sustainability comes with many opportunities and brings material benefits, including a positive impact on the financial statements:

Clean Revenues:

Supply chain sustainability can contribute to clean revenues, driving value from sustainable investors, ESG ETFs and inclusion in Sustainable Indices such as Dow Jones Sustainable Index or DJSI. Dow Jones Sustainability Index family tracks the stock performance of the world's leading companies in terms of economic, environmental and social criteria.

Eco-risk Mitigation:

Embedding ESG in supply chain can help mitigate risks posed by environmental or labor laws. Moreover, companies can reduce likelihood of business disruptions caused by environmental issues that can occur in supply chains, such as toxic waste, water pollution etc. Such issues not only pose legal and regulatory risks but also – reputational risks.

Cost Optimizations:

Supply chain sustainability allows to gather inefficiencies in the supply chain operations. For example – the amount of waste produced can be an indicator of abortive or over procurement, excess carbon emissions can indicate machinery or operational inefficiencies. Such cases indicate improvements in supply chain management practices and hence results in cost optimizations.

Customer hedging:

Consumers expect and will certainly appreciate an ability to see the production, or the delivery chain of the brands they interact with or products they consume. Transparency through supply chain sustainability can help companies quickly adapt to consumers who prefer environmentally stable brands.

Opportunities for suppliers and supply chain participants

Supply chain sustainability is not only an all advantage for corporations and companies but presents massive opportunities for suppliers and to all participants in the supply chain.

Opportunity to go green: Supplier and supply chain participants themselves have an opportunity to go green and embed sustainability on its own. As a result, such suppliers can gain material, fiscal and economic benefits for their own business. A sustainable supplier or a supply chain participant with sustainability as a strategic objective can attract new business from customers who are willing to only work with such participants.

More business from customers: Incorporation of sustainability and a focus on ESG in suppliers own business and operations can help with more business from existing customers who have good sustainable practices and robust ESG strategies.

Meet the sustainable expectations: Many companies have commitments to their investors (sustainability frameworks) to engage their supply chain participants and embed good environmental and social practices. Therefor an ESG approach in their own operations will be beneficial.

Reach out to us

Private equity firms are required to have an ESG strategy which is aligned to the limited partner’s ESG focus. Private equity industry is under greater scrutiny than ever before, and PE firms must do a better job of capturing and tracking the value they are creating and the impact of their activities.

SIOChain - Supply chain sustainability management system positions you stronger growth working closely with suppliers or partners to manage your environmental and social impact. Through supplier engagement, supplier recognition, and sustainable procurement, you can manage risks while increasing productivity and efficiency within the value chain

Our team provides services and due diligence to not only identify ESG opportunities but help our clients quantify potential ESG benefits and risks, incorporate ESG policies into the strategies and activities, facilitate transactions between asset buyers and sellers, and provide confidence among all parties that ESG commitments are made, and risks are managed.

It is very important that companies make sustainability and ESG a central component of their business model. “We know that climate risk is investment risk. But we also believe the climate transition presents a historic investment opportunity”, says Lary Fink from BlackRock. Authoritative statements like these present an opportunity for companies to prepare their business and our economy against the greatest global threats while it opens doors for capital access.

Effective communication with sustainable investors focused on your ESG progress is an important component of your ESG strategy. It fills the gap between investor expectations and your sustainability

or ESG strategy.Sustainability and ESG communication is an approach to engage your customers and

investors, and to showcase your ESG progress and sustainability commitments.

It is imperative to focus on supply chain sustainability in order to meet your sustainability commitments and meet your environmental targets. SIOChain™, a technology platform is designed to engage your suppliers and collaborate to measure, monitor and embed sustainability and ESG in your supply chain.

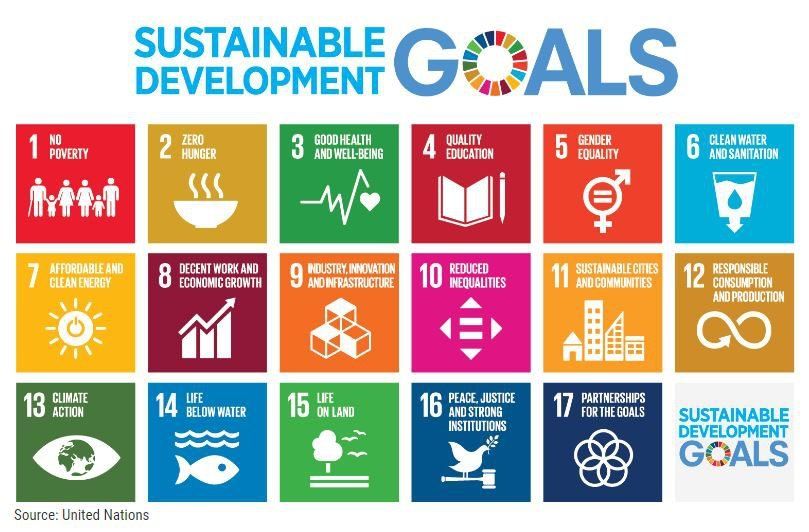

The purpose of sustainable financing, as stated by the UN Environment Programme , is to increase the level of financial flows (from banking, micro-credit, insurance and investment) from the public, private and not-for-profit sectors to sustainable development priorities. The aim is to align financial systems, working with countries, financial regulators and financial sectors, and direct capital allocation to sustainable development that will shape the production and consumption patterns of tomorrow. Financial mechanisms such as Green Bonds, Social Bonds and ESG Linked Loans help this alignment as they promote public-private partnerships for sustainable development. The Sustainable Development Goals (SDGs) are a collection of 17 global goals set by the United Nations General Assembly as an agenda for the year 2030. These 17 SDGs are an urgent call for action by developing and developed countries and provide a blueprint for the peace and prosperity for people and the planet. The SDGs also recognize issues related to the planet, such as biodiversity, and to people, such as poverty, and accept that solutions to address all of these issues are interconnected. Green Finance (or Sustainable Finance) instruments such as Green Bonds, and bonds focused on other thematic issues such as Social Bonds, Sustainability Bonds or Sustainable Development Goal Bonds, can act as a strong bridge to the SDGs. Such initiatives allow the flow of capital to execute and meet corporate sustainability commitments. They are also attractive to institutional investors as they perceive financial commitments to sustainability as a good indicator of a corporation's ESG progress. Related: More about Social Bonds