ESG Strategy – Attract investors through ESG communication

MACK BHATIA

Meet your investors' expectations on your ESG progress and sustainability commitments

Effective communication with your investors focused on your ESG progress is an important component

of your ESG strategy. It fills the gap between investor expectations and your sustainability

or ESG strategy.

Sustainability and ESG communication is an approach to engage your customers and

investors, and to showcase your ESG progress and sustainability commitments.

It is expected to have a positive influence on the shareholder value when you project how you

drive business value with ESG & sustainability. The following checklist is essential to formulate a

good ESG communication plan.

Checklist for an effective ESG communication plan

Check 1 : How does ESG fit into the business model

There are numerous opportunities to fit ESG through strategic and operational areas. This

includes strategic areas such as product development or operational areas such as

manufacturing, packaging or transportation and delivery. It is imperative to specify such

strategic and operational areas in your sustainability / ESG communication plan and

messaging.

Check 2 : Identify a list of ESG Investors

Sustainable investing is growing in demand

A recent survey by BlackRock indicates that the

respondents are planning to double their ESG investments by 2025. In addition to your

biggest institutional investors, it is useful to identify other asset managers, ESG fund

managers or ESG index owners who may be willing to add your ticker in the portfolio. This is

one of the ways where ESG communication drives a direct financial impact.

Check 3 : The top 5 expectations from your investors

Your investor relations team would have a good understanding of the expectations and

challenges from your institutional investors. It is also a good idea to research and analyze,

and check if all existing or potential investors have similar or varied expectations. To

formalize the top 5 and the most common expectations becomes very useful for your ESG

communication initiatives.

Check 4 : Ensure ESG communication covers the material impact

Beyond the environmental benefits, investors also expect that companies showcase the

material and financial impact of respective ESG initiatives. Your communication and

messaging should include proven impact on financial health of the company. This could

include areas such as increase in customer acquisition from new sustainable products or

cost benefits derived from improved operational efficiency (reduction of waste, inclusion of

recycled packaging etc.).

Check 5 : Engage investor relations, map stakeholder expectations

Your investor relations team will have the closest relationship with institutional investors. In

addition to engaging them, we should also identify all internal and other external

stakeholders who may influence or impact the ESG communication strategy. These

stakeholders include internal teams such as marketing and corporate finance, and external

stakeholders such as suppliers, customers and paid media.

Check 6 : Create a Digital Channel Strategy for ESG communication

Developing a digital channel strategy is an absolute imperative to engage with your

investors and customers. Your investors will look at every possible digital outlet, primarily,

to know about your ESG initiatives and then validate them with their own tools to check the

financial impact. There are varied digital strategies but the most effective one is to create a

dedicated digital vertical focused on sustainability with accountability to deliver on

sustainability and ESG goals.

Check 7 : Meet regulatory and compliance requirements

Beyond the creative aspect of ESG communication, it is important that we meet regulatory

and compliance requirements for our sustainability and ESG messaging. ESG regulation is

an accelerating global trend hence regulation of 'soft laws' by PRI for investors, and

expectations for companies to undertake due diligence on ESG disclosures is highly

encouraged. We also recommend that ESG communication teams refer to similar

regulations such as EU - taxonomy regulations or sustainability disclosure regulations.

Check 8 : Share your ESG performance updates regularly

Maintaining an email list of engaged or potential investors is a great way to organize and

share regular updates on your ESG initiatives. This can also be part of a digital channel

strategy when added as another tactic to attract more investors, customers and to keep

them engaged on your ESG improvements. Providing regular updates is a successful

strategy to generate investor momentum.

Check 9 : Back your messaging with measured data

To negate any perceptions of 'green washing', it is highly recommended that your

ESG messaging is supported by data (and facts) to back your claims. At the least, we

recommend to highlight any processes in place to measure data for your ESG initiatives as

this can generate high level of confidence among investors.

Check 10 : Utilize technologies to deliver on ESG transparency

ESG transparency can deliver on trust among your investors, customers and other

stakeholders alike. Platforms such as SIOChain™ and solutions such as bar code tracking

can activate mechanisms to further engage your investors and customers. It is helpful to

carry out such technologies or applications to support ESG communication initiatives.

If the above resonates with you, see more at ESG Communication services

or contact us through the form below

Reach out to us

Private equity firms are required to have an ESG strategy which is aligned to the limited partner’s ESG focus. Private equity industry is under greater scrutiny than ever before, and PE firms must do a better job of capturing and tracking the value they are creating and the impact of their activities.

SIOChain - Supply chain sustainability management system positions you stronger growth working closely with suppliers or partners to manage your environmental and social impact. Through supplier engagement, supplier recognition, and sustainable procurement, you can manage risks while increasing productivity and efficiency within the value chain

Our team provides services and due diligence to not only identify ESG opportunities but help our clients quantify potential ESG benefits and risks, incorporate ESG policies into the strategies and activities, facilitate transactions between asset buyers and sellers, and provide confidence among all parties that ESG commitments are made, and risks are managed.

It is very important that companies make sustainability and ESG a central component of their business model. “We know that climate risk is investment risk. But we also believe the climate transition presents a historic investment opportunity”, says Lary Fink from BlackRock. Authoritative statements like these present an opportunity for companies to prepare their business and our economy against the greatest global threats while it opens doors for capital access.

It is imperative to activate ESG and sustainability through the supply chain to develop transparency and visibility on ESG and sustainability practices. Companies need to collaborate with their suppliers and supply chain participants in upstream and downstream operations in order to meet their environmental and sustainability commitments. See more.

It is imperative to focus on supply chain sustainability in order to meet your sustainability commitments and meet your environmental targets. SIOChain™, a technology platform is designed to engage your suppliers and collaborate to measure, monitor and embed sustainability and ESG in your supply chain.

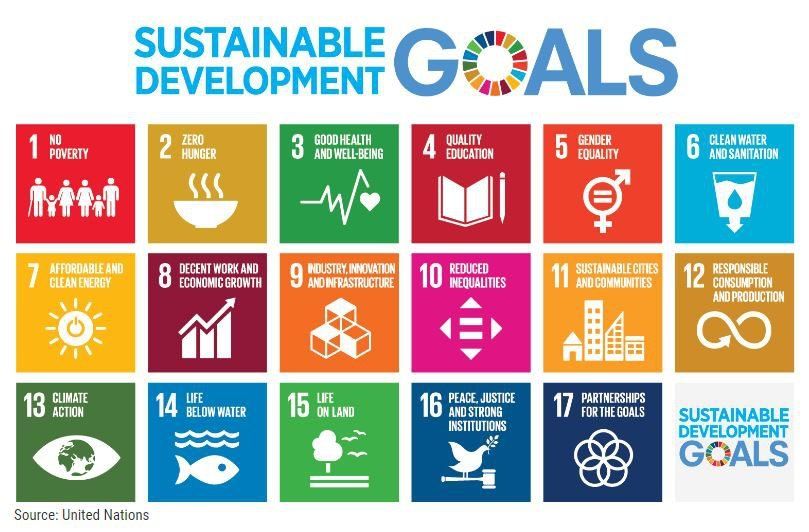

The purpose of sustainable financing, as stated by the UN Environment Programme , is to increase the level of financial flows (from banking, micro-credit, insurance and investment) from the public, private and not-for-profit sectors to sustainable development priorities. The aim is to align financial systems, working with countries, financial regulators and financial sectors, and direct capital allocation to sustainable development that will shape the production and consumption patterns of tomorrow. Financial mechanisms such as Green Bonds, Social Bonds and ESG Linked Loans help this alignment as they promote public-private partnerships for sustainable development. The Sustainable Development Goals (SDGs) are a collection of 17 global goals set by the United Nations General Assembly as an agenda for the year 2030. These 17 SDGs are an urgent call for action by developing and developed countries and provide a blueprint for the peace and prosperity for people and the planet. The SDGs also recognize issues related to the planet, such as biodiversity, and to people, such as poverty, and accept that solutions to address all of these issues are interconnected. Green Finance (or Sustainable Finance) instruments such as Green Bonds, and bonds focused on other thematic issues such as Social Bonds, Sustainability Bonds or Sustainable Development Goal Bonds, can act as a strong bridge to the SDGs. Such initiatives allow the flow of capital to execute and meet corporate sustainability commitments. They are also attractive to institutional investors as they perceive financial commitments to sustainability as a good indicator of a corporation's ESG progress. Related: More about Social Bonds