ESG and Banks - A crucial component of an ESG ecosystem

Embedding ESG into bank's s business model - key strategies to leverage

How can banks pursue ESG?

There are many ways banks embed ESG into their own business strategies. However, our research states that such strategies mainly fit into the following 3 categories: Sustainable Finance, Operational Efficiencies and Responsible Investing (also known as Sustainable Investing, or ESG Investing). We will go through each of these as we touch upon these topics, with examples:

Leverage Sustainable Finance

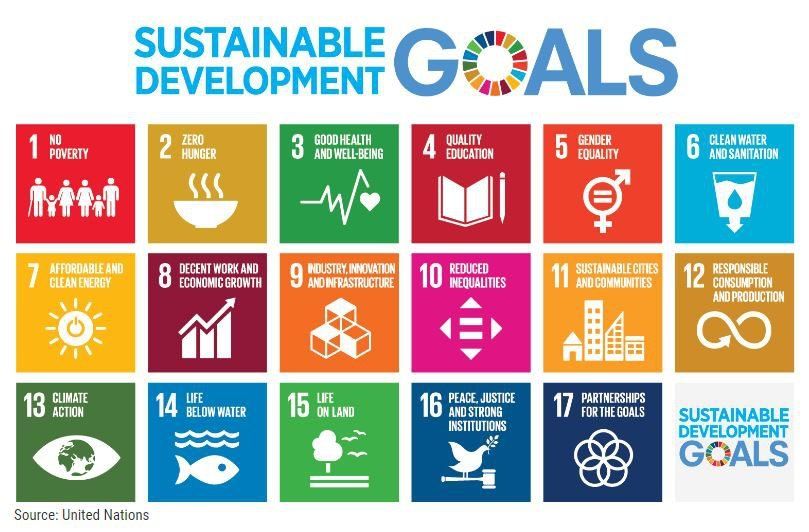

Banking sectors enhance their lending portfolios to include ESG as a main-stream component in the sustainability strategy. Responsible lending by the banking sector and other financial institutions sends a strong signal among the corporate sector looking for capital access. One of the ways this can happen is when banks prioritize loans and other lending instruments for companies with sustainability and ESG as a strategic commitment.

As more and more companies prepare a transition to a greener business model, it becomes more than ever, and imperative, that financial institutions steer their loan portfolios accordingly; this could be easier said than done as a few banks may find it challenging to shift their investments from existing carbon intensive projects to low-carbon driven initiatives. Nonetheless, this is a necessary step that can be part of the bank’s strategic and business objectives.

Banks can leverage various sustainable finance instruments available in the market to embed ESG in their own business; this is to improve their lending portfolios and accommodate sustainable projects. Sustainable finance instruments such as Green Loans or Sustainability linked loans presents a massive opportunity. The total green issuance surpassed $265Bn USD in 2020* and shows a growing trend in 2021 and beyond. Although Sustainability Linked Loans issuance is slightly higher than the green loans, Green loans still constitute at-least 20% of the total sustainable finance issuance at the time of this article.

Other sustainable finance instruments such as Green Bonds, Social Bonds, Sustainability Linked Bonds or even Transition Bonds are tailor made debt instruments to help companies support the ESG initiatives, and banks can assist.

To know more about Sustainability Linked Loans or Green Loans, you can read more at sustainable finance or connect with us here.

Canada became the latest country to join the Green Loans market when Bank of Montreal delivered the first labeled Green Loan in Canada granting loans to Atlantic Packaging; the aim is to finance a new 100% recycled container board facility. With this, Canada joins Europe and United States in the ever-growing sustainable lending market.

What is the difference between Sustainability Linked Loans and Green Loans? You can always connect with us here for questions like these and more.

Operational Efficiency

Environmental, social, and governance (ESG) issues are front and center for the North American’ biggest banks. A renewed focus from the US government on climate change and environmental issues has generated a wave of announcements with quite a few banks including JP Morgan, Wells Fargo, Bank of America, and Fifth Third – all unveiling measures to enhance their commitment to ESG themes.

JPMorgan Chase’s commercial banking arm has set up a new ‘Green Economy’ specialized industry team, which will provide dedicated banking services and expertise to companies that produce environmentally friendly goods and services or focus on environmental conservation.

Bank of America announced a goal of deploying and mobilizing $1 trillion by 2030 through its Environmental Business Initiative in order to accelerate the transition to a low-carbon, sustainable economy.

Meanwhile, Wells Fargo has entered into a 20-year renewable energy purchase agreement with Florida-based NextEra Energy Resources. Under the agreement, Wells Fargo will consume 100% of the solar energy produced by the Blackburn Solar Project, a 58-megawatt 600-acre solar farm planned for Catawba County, North Carolina, under Duke Energy’s Green Source Advantage (GSA) program.

There are numerous ways banks can pursue operational efficiencies to align with their own ESG strategy, therefore creating a cumulative effect through the ESG ecosystem.

Responsible Investing

Responsible investing is a strong catalyst driving an ESG ecosystem, specifically, when its driven by large institutional investors such as BlackRock ( $8.8 Trillion USD AUM, Read Larry Fink’s statement here ), Charles Schwab ( $3.25 Trillion USD AUM), T Rowe Price ( Close to 2 Trillion USD AUM, Sustainable Investing at T Rowe Price ) and more.

Total assets under management under all Sustainable and ESG ETFs crossed $15 Trillion USD in 2020 – a testament that responsible investing is a brilliant strategy that combines both; financial and environmental considerations. Contact us here to learn more about the best of ESG ETFs and more.

The wealth and asset management functions within the banks have a potential to enhance the long-term sustainable performance of the portfolios. Banks can deepen their portfolios by integrating ESG factors – both financial and non-financial, into their current or future investments, showcasing environmental stewardship while strengthening its own balance sheet.

Can sustainability and supply chain finance work together?

Supply chain finance, also referred as Reverse factoring is when a finance company, such as a bank, interposes itself between a company and its suppliers and commits to pay the company's invoices to the suppliers at an accelerated rate in exchange for a discount. The total market for supply chain finance is estimated to be $275 bn; this is according to Wikipedia’s data. But conceptually speaking, the potential market for supply chain finance encompasses every invoice and receipt issued by corporates, which could be more than $1.7 Trillion.

Can sustainability and supply chain finance work together? This remains yet to be seen but seems possible.

How can we help

theSustainability.io (TSIO) delivers Sustainability and ESG Solutions to corporations, companies, banks and investment firms.

Combining a unique expertise in technology, data and an in-depth knowledge of an ESG ecosystem, the technology solutions and services deliver on transparency, trust and reliability between corporations and investors, primarily to aid the flow of capital to ESG initiatives while showcasing business value to sustainable investors.

Reach out to us for any ESG related query or learn about SIOChain – a unique platform developed by theSustainability.io to enable supply chain sustainability. For any questions, comments or enquiries, please connect with us at theSustainability.io contact us page.

Reach out to us