Your ESG consulting partners

MACK BHATIA

Meet your ESG objectives and engage your investors with our team

In a remarkably short time span, Environmental, Social and Governance principles (ESG) have gained prominence among investors, from top performance-driven asset managers to institutional investors (including pension funds and sovereign wealth funds) and wealth managers. This is a response to pressure from their own investors and industry regulators to incorporate ESG-consciousness into investing mandates to address climate change and achieve more sustainable, long-term returns.

This primarily boils down to how companies and business incorporate ESG practices and initiatives in their business model and operations to engage investors and help them develop an environmentally friendly portfolio. This also means more access to capital for you.

Our services and how we work with you

1. ESG in your business model

Our global team of ESG professionals’ dives into your existing business model to identify opportunities of positive impact on the planet or the people. Our team will practice adequate due diligence to not only identify ESG opportunities but help our clients quantify potential ESG benefits and risks, incorporate ESG policies into the strategies and activities, facilitate transactions between asset buyers and sellers, and provide confidence among all parties that ESG commitments are made, and risks are managed.

Our team may also identify new opportunities as we get deeper into your business and industry, in which case we will develop a business case / plan needed to succeed.

Who Benefits:

Your executive team, c-suite and it sends a strong message to institutional investors on your commitment to meet ESG objectives.

.

2. Cross Functional Collaboration

Our professionals liaise cross functionally among your company and various divisions to connect the dots and to articulate the key roles every division can play. This is important to develop a coherent ESG narrative. The primary organization functions involved are investor relations, and marketing and communications, sustainability leadership and finance (for sustainable finance opportunities).

Our team ensures cross functional cohesion to ensure smooth execution of ESG strategy.

Who Benefits:

Internal stakeholders such as employees, sustainability leaders, operations and executive team.

3. Strategic Marketing and Corporate Communication

Our team builds a global marketing strategy in alignment with short and long-term company ESG goals. We bring in a creative team of experts with a strong ESG background to develop and execute on marketing campaigns and amplify your ESG success and increase visibility among the investor audience. We engage with marketing / communication teams to develop activities as it relates to formulated ESG objectives. We make certain a coherent internal and external set of messages and communications platform. Our team works across the organization’s division leaders to develop market materials for ESG initiatives.

Our ESG professionals will manage a wide range of copy (content strategy/marketing), including press releases, website content, social media posts and written interviews. We nurture the development of your earned and/or paid media strategy to ensure a steady flow of positive news about your ESG progress – hence, driving an increase in national and international coverage.

Who Benefits: External stakeholders, investors, executive team and the board.

4. Manage company’s competitive intelligence, business and data analytics needs

A few of our team members come from an investor background, having worked with institutional investors in the past; therefore we understand the ESG integration and ESG data needs that builds upon the investor’s confidence on your ESG progress. We have data tools and a vetted data provider network to share timely ESG data with your investors or other stakeholders as and when needed. We ensure data integrity and honesty in presenting your ESG progress to all stakeholders.

We also have internal data tools (a couple also driven by Artificial Intelligence) to share recommendations for us to create, pivot or manage ESG initiatives. We can leverage these tools to timely manage risks or to gain a competitive industry advantage.

5. Reports Audit and Showcasing Impact

We have internal team members with expertise in reporting frameworks and standards such as TCFD, GRI or SASB. Our engagement with you includes checking, auditing and maintaining the sanctity of these reports. We ensure ESG integrity in such reports and that the presentation is clear, concise and well understood by all stakeholders, readers and investors. Showcasing your impact remains our first priority, and we make certain thats its backed up by data to maintain your ESG integrity.

Work with us

theSustainability.io is the premiere sustainability and ESG solutions provider backed by a global team of domain experts. We work with corporations, companies and governments capture opportunities, manage risk, and drive growth in an orderly transition to sustainability.

Reach out to us

Private equity firms are required to have an ESG strategy which is aligned to the limited partner’s ESG focus. Private equity industry is under greater scrutiny than ever before, and PE firms must do a better job of capturing and tracking the value they are creating and the impact of their activities.

SIOChain - Supply chain sustainability management system positions you stronger growth working closely with suppliers or partners to manage your environmental and social impact. Through supplier engagement, supplier recognition, and sustainable procurement, you can manage risks while increasing productivity and efficiency within the value chain

It is very important that companies make sustainability and ESG a central component of their business model. “We know that climate risk is investment risk. But we also believe the climate transition presents a historic investment opportunity”, says Lary Fink from BlackRock. Authoritative statements like these present an opportunity for companies to prepare their business and our economy against the greatest global threats while it opens doors for capital access.

It is imperative to activate ESG and sustainability through the supply chain to develop transparency and visibility on ESG and sustainability practices. Companies need to collaborate with their suppliers and supply chain participants in upstream and downstream operations in order to meet their environmental and sustainability commitments. See more.

Effective communication with sustainable investors focused on your ESG progress is an important component of your ESG strategy. It fills the gap between investor expectations and your sustainability

or ESG strategy.Sustainability and ESG communication is an approach to engage your customers and

investors, and to showcase your ESG progress and sustainability commitments.

It is imperative to focus on supply chain sustainability in order to meet your sustainability commitments and meet your environmental targets. SIOChain™, a technology platform is designed to engage your suppliers and collaborate to measure, monitor and embed sustainability and ESG in your supply chain.

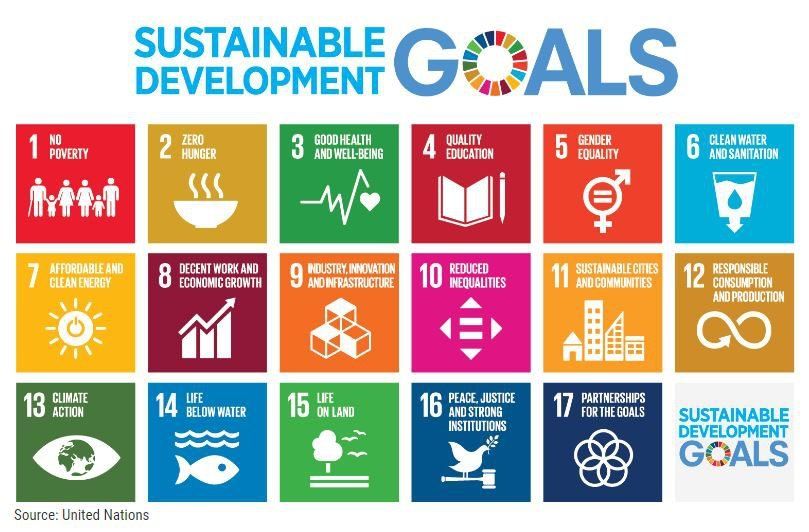

The purpose of sustainable financing, as stated by the UN Environment Programme , is to increase the level of financial flows (from banking, micro-credit, insurance and investment) from the public, private and not-for-profit sectors to sustainable development priorities. The aim is to align financial systems, working with countries, financial regulators and financial sectors, and direct capital allocation to sustainable development that will shape the production and consumption patterns of tomorrow. Financial mechanisms such as Green Bonds, Social Bonds and ESG Linked Loans help this alignment as they promote public-private partnerships for sustainable development. The Sustainable Development Goals (SDGs) are a collection of 17 global goals set by the United Nations General Assembly as an agenda for the year 2030. These 17 SDGs are an urgent call for action by developing and developed countries and provide a blueprint for the peace and prosperity for people and the planet. The SDGs also recognize issues related to the planet, such as biodiversity, and to people, such as poverty, and accept that solutions to address all of these issues are interconnected. Green Finance (or Sustainable Finance) instruments such as Green Bonds, and bonds focused on other thematic issues such as Social Bonds, Sustainability Bonds or Sustainable Development Goal Bonds, can act as a strong bridge to the SDGs. Such initiatives allow the flow of capital to execute and meet corporate sustainability commitments. They are also attractive to institutional investors as they perceive financial commitments to sustainability as a good indicator of a corporation's ESG progress. Related: More about Social Bonds