The importance of communication in sustainability & sustainable strategies

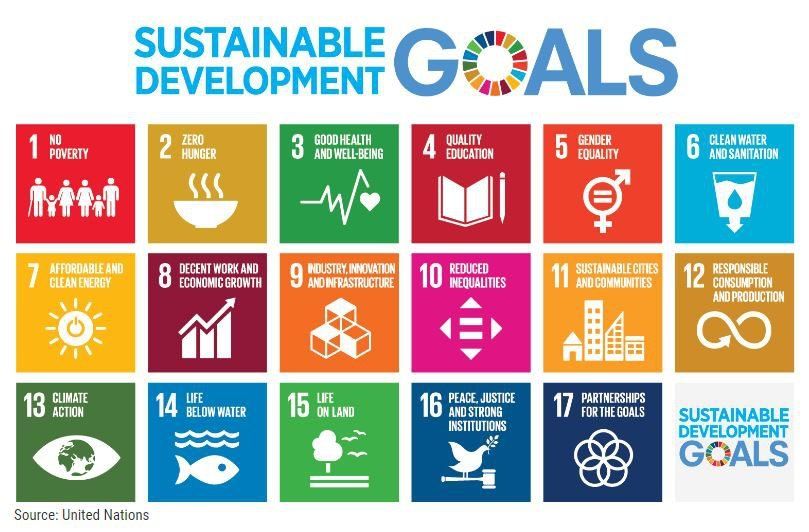

Sustainability, beyond the popularity of the word itself is a business strategy. Companies and organizations can benefit by mapping the objectives of their sustainability strategy with the expectations of the stakeholders – mainly investors and customers. Although a top line plan - this approach has a healthy influence on the bottom-line growth of the company.

Sustainability communication is an approach to engage your customers and investors in order to showcase your progress on sustainability commitments. It is understood to have a positive influence on the shareholder value when you showcase how you drive business value with ESG & sustainability. Sustainability communication effectively engages investors, customers or employees as the key stakeholders, and aligns well with the company's overall strategic objectives as defined by the sustainability action plan. Any action plan should define the role of communication in sustainable development .

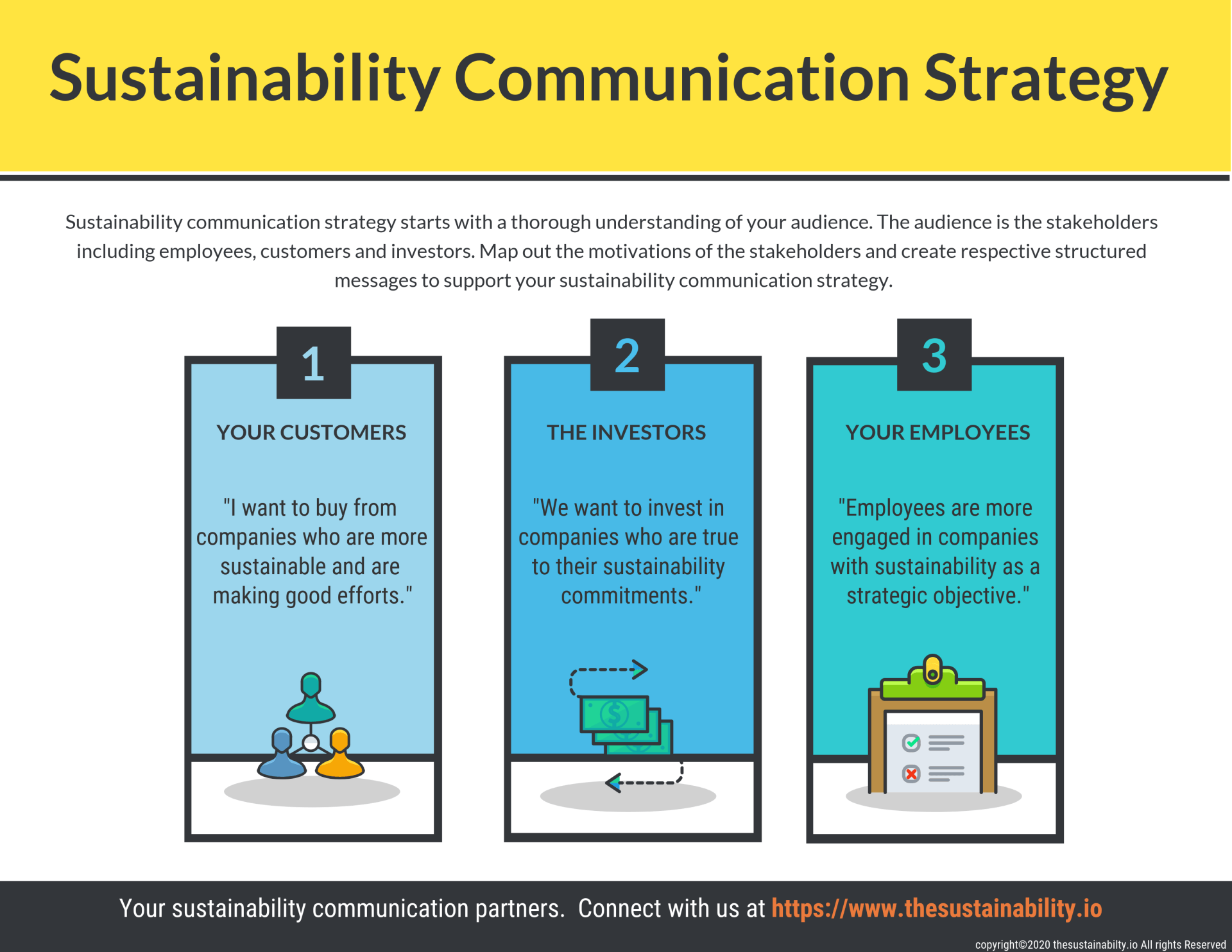

A thorough sustainability communication strategy is mandatory to have the desired benefits – both non-material and material. Sustainability communication strategy, like any other strategy, has to start with a data-driven understanding of an audience and the stakeholders. It is imperative that we map out the motivations with messages that resonates. The right mix of communication channels can then accelerate the delivery of these messages and forward. The below illustration explains the concept.

As an example, Institutional investors will look for sustainability (or ESG) factors which are likely to have an impact of a company's financial performance, while a customer will be interested in non-material factors such as sustainable sourcing or sustainable products. Hence, a thorough sustainability communication strategy is mandatory to have the desired benefits – both non-material and material.

Reach out to us