Enable a Sustainable Supply Chain - SIOChain

MACK BHATIA

Sustainable Supply Chain Management platform.

In recent years a rising number of multinational corporations have pledged to work only with suppliers that adhere to social and environmental standards. Typically, these MNCs expect their first-tier suppliers to comply with those standards, and they ask that those suppliers in turn ask for compliance from their suppliers—who ideally ask the same from their suppliers. And so on. The aim is to create a cascade of sustainable practices that flows smoothly throughout the supply chain, or, as we prefer to call it, the supply network.

The world is changing faster than ever. Having a sustainable supply chain is pivotal for businesses trying to stay afloat amidst all of today's uncertainty.

Sustainability, beyond a corporate social responsibility initiative, is now a business strategy.

In a comprehensive case study by Harvard Business Review, researchers Veronica H. Vellina and Dennis A. Gioia presents some of the key

challenges and opportunities to build a sustainable supply chain. The research highlights some of the key problems faced by corporations where the supply chain is spread across geographies. Many suppliers lacked environmental management systems and procedures to handle other problems such as hazardous labor conditions, waste management and other related practices.

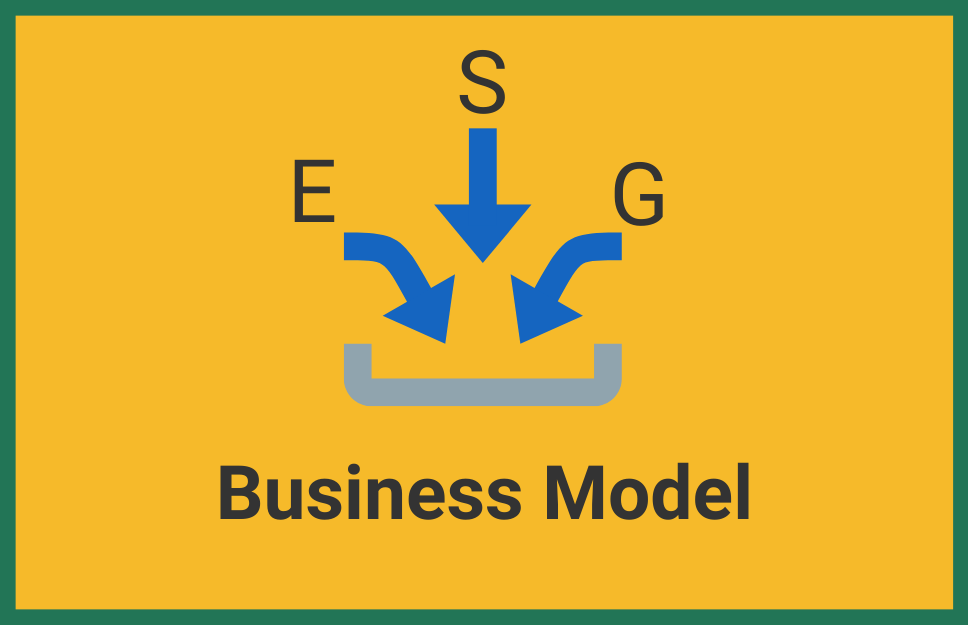

Minimizing environmental impact, beyond the environmental benefits has huge financial benefits for a corporation. Recently, CNBC while speaking with a leading investor – DWS Group reported that “ over $19 billion flowed into an ESG ETF in 2020, bringing a total to over of $40 billion “, they said. ESG ETF are exchange traded funds which invests in companies with strong sustainability progress or who has Environmental €, Social (S) and Governance (G) metrics as one of their core strategic objectives.

Beyond the above reducing unnecessary costs and creating a brand story that authentically connects with an audience are all positive end goals that businesses desire. However, the precise steps and paths to get there can be difficult to discern.

Corporations have realized that it will be difficult to meet the commitments unless they have visibility in their supply chains and unless they can align them to build a sustainable supply chain. Sometimes the solutions are rooted in areas often overlooked by companies just starting on their path towards a sustainable supply chain.

Enable a Sustainable Supply Chain - SIOChain

theSustainability.io, a corporate sustainability solutions company, presents a very neat solution around this called as

SIOChain. The technology platform allows such corporations to collaborate with their suppliers and other supply chain participants to measure sustainability metrics. This encourages a trust and transparency among the supply chain participants and aligns everyone with a single objective – meet sustainability commitments.

These commitments are usually strategically aligned to corporations sustainability strategy such as net zero carbon emissions, reduction of plastic and more. The sustainable supply chain platform, SIOChain, is well designed to meet these needs. The platform presents a very effective way to engage and align with all supply chain participants, so the corporations can showcase their sustainability progress to their investors and create a brand story around the sustainable supply chain initiative.

You can learn more about sustainable supply chain and drop your questions at

Sustainable supply chain management page.

Reach out to us

Private equity firms are required to have an ESG strategy which is aligned to the limited partner’s ESG focus. Private equity industry is under greater scrutiny than ever before, and PE firms must do a better job of capturing and tracking the value they are creating and the impact of their activities.

SIOChain - Supply chain sustainability management system positions you stronger growth working closely with suppliers or partners to manage your environmental and social impact. Through supplier engagement, supplier recognition, and sustainable procurement, you can manage risks while increasing productivity and efficiency within the value chain

Our team provides services and due diligence to not only identify ESG opportunities but help our clients quantify potential ESG benefits and risks, incorporate ESG policies into the strategies and activities, facilitate transactions between asset buyers and sellers, and provide confidence among all parties that ESG commitments are made, and risks are managed.

It is very important that companies make sustainability and ESG a central component of their business model. “We know that climate risk is investment risk. But we also believe the climate transition presents a historic investment opportunity”, says Lary Fink from BlackRock. Authoritative statements like these present an opportunity for companies to prepare their business and our economy against the greatest global threats while it opens doors for capital access.

It is imperative to activate ESG and sustainability through the supply chain to develop transparency and visibility on ESG and sustainability practices. Companies need to collaborate with their suppliers and supply chain participants in upstream and downstream operations in order to meet their environmental and sustainability commitments. See more.

Effective communication with sustainable investors focused on your ESG progress is an important component of your ESG strategy. It fills the gap between investor expectations and your sustainability

or ESG strategy.Sustainability and ESG communication is an approach to engage your customers and

investors, and to showcase your ESG progress and sustainability commitments.

It is imperative to focus on supply chain sustainability in order to meet your sustainability commitments and meet your environmental targets. SIOChain™, a technology platform is designed to engage your suppliers and collaborate to measure, monitor and embed sustainability and ESG in your supply chain.

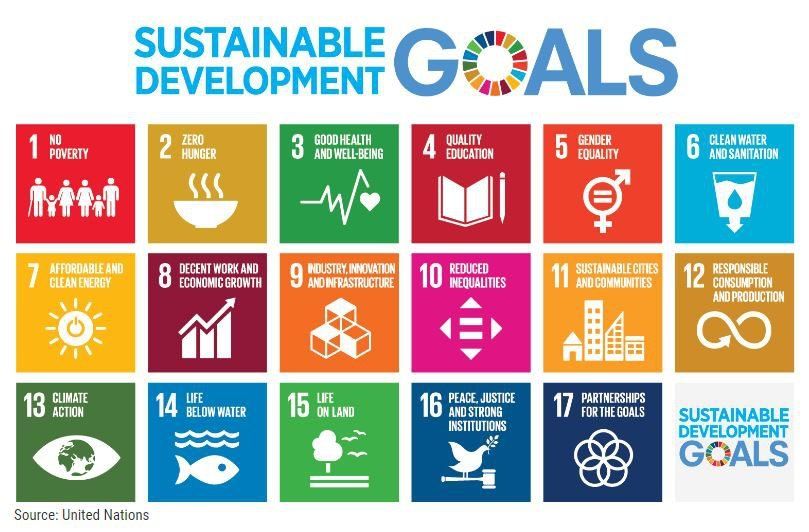

The purpose of sustainable financing, as stated by the UN Environment Programme , is to increase the level of financial flows (from banking, micro-credit, insurance and investment) from the public, private and not-for-profit sectors to sustainable development priorities. The aim is to align financial systems, working with countries, financial regulators and financial sectors, and direct capital allocation to sustainable development that will shape the production and consumption patterns of tomorrow. Financial mechanisms such as Green Bonds, Social Bonds and ESG Linked Loans help this alignment as they promote public-private partnerships for sustainable development. The Sustainable Development Goals (SDGs) are a collection of 17 global goals set by the United Nations General Assembly as an agenda for the year 2030. These 17 SDGs are an urgent call for action by developing and developed countries and provide a blueprint for the peace and prosperity for people and the planet. The SDGs also recognize issues related to the planet, such as biodiversity, and to people, such as poverty, and accept that solutions to address all of these issues are interconnected. Green Finance (or Sustainable Finance) instruments such as Green Bonds, and bonds focused on other thematic issues such as Social Bonds, Sustainability Bonds or Sustainable Development Goal Bonds, can act as a strong bridge to the SDGs. Such initiatives allow the flow of capital to execute and meet corporate sustainability commitments. They are also attractive to institutional investors as they perceive financial commitments to sustainability as a good indicator of a corporation's ESG progress. Related: More about Social Bonds