How to build a strong Sustainability strategy

Sustainability Strategy is very cohesive with any business strategy. However, it needs a structured approach for companies and corporations to reap the material, fiscal and economic benefits. See on how to structure business sustainability strategies.

Steps to an effective and a scalable sustainability strategy

It is imperative that companies, corporations, governments and investors follow a structured approach towards a transition to sustainability. Following are the steps we undertake to help our customers and clients succeed with their sustainability initiatives:

- Business Case: Companies in a transition from corporate responsibility functions to full - fledged sustainability and ESG operations division usually requires a business case to get funds for their departments. This is also applicable to existing sustainability functions who require department funding from corporate budgets to expedite their sustainability and ESG plans. Such business case development exercise should certainly mention the material, economic and fiscal benefits specifically driven by demands from institutional investors, and government regulations. It also helps when a business case mentions the growing funds flowing into ESG specific exchange traded funds (see here) enabling access to capital and a potential improvement in a shareholder value.

- Specific Focus Areas: Nailing down the operational areas impacted by sustainability becomes the next essential step. Companies usually have multiple areas of operations. These operational areas may stretch long - from research and development up-to their supply chain and until the delivery of the end product to their customers. We work through every operational areas for our clients and customers to identify opportunities for sustainability. As an example, for a retail company like Walmart - the opportunity resides in both upstream and downstream operations such as sustainable resourcing to sustainable packaging.

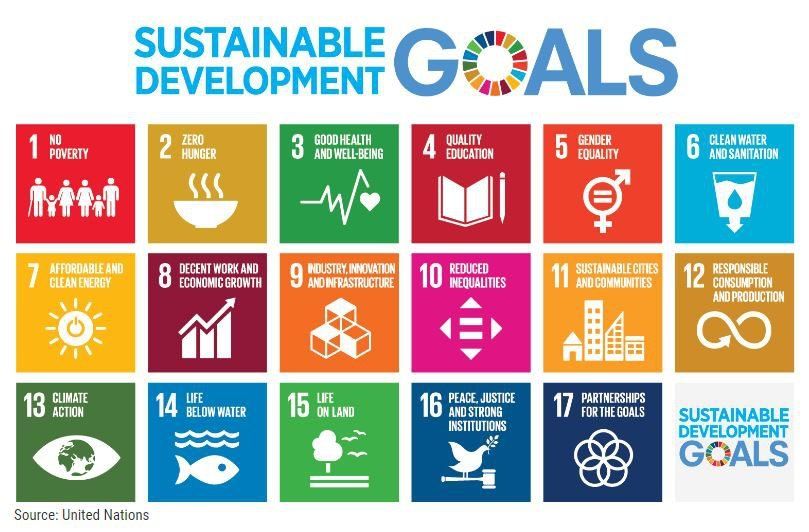

- Goals & SDG Alignment: Once the operational areas are defined, we work with strategic decision makers (sustainability teams and executive team members) to ensure that we have measurable goals and objectives over the period of time. This is important because we might have to work to identify baseline for sustainability goals (such as carbon emissions, use of plastics etc.) to monitor improvements over time. These goals have to be respectively aligned with one or more of the 17 Sustainability Development Goals formulated by the United Nations for us to refer.

- Formulating Assessment Indicators ( KPIs): To help us out United Nations Sustainable Development Goals (UN SDGs, also known as the Global Goals) are 17 goals with 169 targets that all UN Member States have agreed to work towards achieving by the year 2030. Each target also comes up with associated indicators (232 indicators) for us to track our progress. While targets specify the goals, indicators represent the metrics by which the we can track whether these targets are achieved. Our expert team accurately aligns the formulated goals with the right SDGs, targets and indicators. It is extremely important that you engage external expertise to do so.

- ESG Integration & Progress: ESG integration and metrics is where companies and corporations can reap the material, fiscal and economic benefits. Institutional investors regularly look for ESG integration and metrics through varied sources such as ESG data or ESG disclosure materials (See more). Investors also look at ESG and Sustainability communication materials published by the companies themselves including on websites and other digital engagement channels (See here). Such communication materials is also looked by governments, NGOs and more and hence it is important that any ESG disclosures and ESG communications undertaken are used to showcase business value (instead of just marketing). Our team of ESG and communication experts can help ensure this.

- Engaging your Stakeholders: One of the biggest opportunities in a successful execution of sustainability strategy lies with engaging internal and external stakeholders. While internal stakeholders include employees and varied departments such as Corporate Finance, Corporate Communications, Investor relations and more, external stakeholders are primarily investors and customers. While engaging internal stakeholders is a necessary for a flawless execution, external stakeholders are primary drivers for access to capital (from tax benefits and from institutional investors), and revenues (from customers). Our approach of creating a stakeholder matrix with defined and catered messaging has been very successful with our customers and clients.

- Engaging with your Suppliers: As all companies and corporations have supply chains in one form or the other, it is essential to engage your suppliers. These supply chains extend around the world, and beyond being prone to natural and political challenges - they face other risks such as climate change, water scarcity and in some cases poor labor conditions. All of these cases fall under the categories of ESG and sustainability. In one of the articles published by Harvard, it is mentioned the value at stake from sustainability concerns can be as a high as 70% of earnings before interest, taxes, depreciation, and amortization. SIOChain™ – a proprietary technology platform makes it easy for companies to manage supply chain and sustainability risks. It encourages collaboration with suppliers and enable ESG measurement so companies can improve their risk management. ( Know more about SIOChain™).

It is very prevalent that sustainability and ESG provides enormous value as a competitive business strategy improving company’s financial performance. However, it also brings with it complexities that requires a support of an external partner. You can reach out to us to start a conversation with us (Contact us).

Reach out to us