All about Green Bonds

Capital markets and bonds have been at hand in hand since the inception. Ideal world, and in primary markets new stock or bond issues are sold to investors often via mechanism known as underwriting. Long term funds are raised by government entities (municipal, local or national) and business entities. These can be done traded in the secondary markets. This is Wikipedia of bond market – nothing more and nothing less.

Now replace the word “bond” in the above paragraph with “Green Bonds”. When you read it again, you know you have the essence of a Green Bond.

What are Green Bonds

To build upon what you just read – green bonds are simple ordinary bonds like any other bond but with one difference, the issuer promises that they will use the proceeds to green investments, green projects or green assets being refinanced.

Anyone who can issue a bond can also issue a green bond. A government entity (municipality, local or national) or a business entity, or a bank can raise long term funds using a green bond as an instrument.

To add to the above, there is a lot more than “could issue green bonds” because any institution that has never issued a bond in the emerging markets but has a reasonable chance of being credit worthy could have a short at this. Governments that haven’t done sovereign for ages can issue a Green Bonds. There are also green retail instruments like term deposits that banks issue – like a savings kind of a bond and it goes on and on.

Who buys Green Bonds?

It is incredible how many people are buying and investing in green bonds. The level of support from institutional investors, retail investors, governments, treasuries, and even a few central banks are interested in buying green bonds and are trying to find the credible green bonds.

As Sean Kidney, CEO of Climate Bonds Initiative states “The demand is huge – we see over subscription is a norm in this market. Every green bond gets 1.5 times to sometimes as much 6 times as many orders for the body of bond that is offered. This is great for a treasury office, but the biggest investors are institutional investors of various kinds such as pension funds, insurance, government investors”

The concept is very simple, Green bonds, like any other bond has the same investment, same interest rate, same risk but with a very special feature. The money goes to helping us tackle climate change. Climate change is a huge ecological challenge that we all need to address. It is imperative that we all contribute. This is exactly why we need to market the potential of bonds – the type of bond and its intention so to get investors in the primary and secondary markets. Digital marketing has a great potential that all corporations and organizations needs to jump into.

When we see from an issuer perspective – this is absolutely a great question.

The primary reason is that Green Bonds are a great marketing device. There are a whole lot of investors like you and I who care about the environment and the climate change. We would like to have a chance to invest in an equivalent risk instrument. What we are trying to say here is that issuers get to pick new investors. In many cases, we get around 10% – 15%, or even up to 68% new investors to the book. This is great!

The second reason is stickiness, many banks have reported that their existing customers are asking for more of green bonds, or similar instruments such as social bonds or sustainability bonds. This helps in developing a deep relationship with your investors as we get cohesive through a common purpose to help the environment.

Third, there is also a correlation between corporates that issue green bonds and their stock price. We believe that the investors are looking into corporate profiles to check who is in a better place to transition to a green economy. This when added with a less policy risk becomes a very likeable stock.

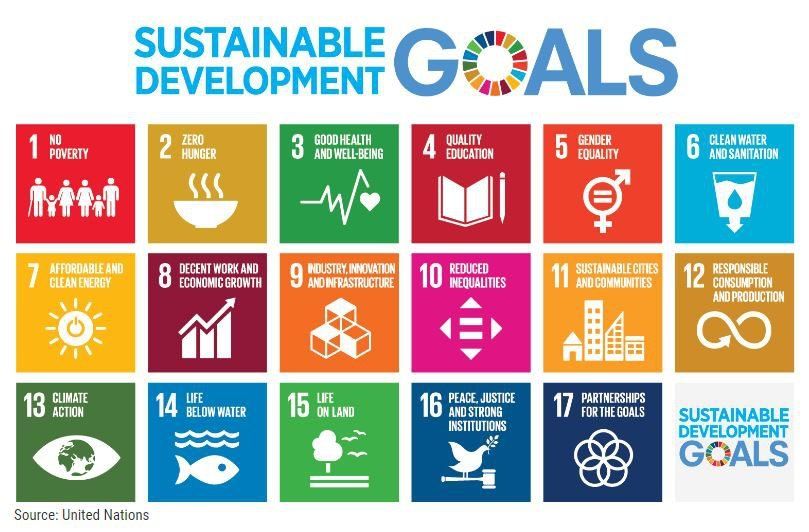

Green bonds started off to be largely used for renewable energy. It evolved, until now, to be used for almost everything that is relevant to our transition to a low-carbon economy and helps to address new environmental challenges.

Examples of relevancy include projects such as for: renewable energy, green buildings (energy efficient buildings), water investments, and even agriculture investments. There is also a great argument on how green bonds or sustainability bonds can be used to fund technology projects such as used for broadband, and about its potential to reduce emissions.

Reach out to us