What is Sustainability Communication? Is it different than ESG Communication..

MACK BHATIA

"Sustainability communication is a business strategy for companies who have integrated sustainability into their operational and strategic activities."

What is Sustainability Communication

Sustainability communication is a business strategy for companies who have integrated sustainability into their operational and strategic activities. It allows the company to tell customers, consumers, and other stakeholders on their business, operations, what you do and how you do your business using a sustainable approach.

It is a mechanism to let customers, investors and other stakeholders know that your company genuinely cares about the environment or other social causes. A big part of creating sustainable development in any industry is to show your investors and customers that you are really working towards your sustainability commitments. An honest communication certainly showcases your company is contributing to environmental or social causes.

The way we see it - “Sustainability communication is a strategic approach to engage stakeholders who either are looking up to you as consumers, or institutional investors with sustainability portfolio, willing to invest in you. It is extremely important for all stakeholders, but specifically for investors to know that you are truly on a sustainable journey”.

Are you pursuing Sustainability Communication or ESG Communication, or both ?

We get asked this question a lot – “How is Sustainability communication different from ESG Communication”. The answer depends on who are you engaging with. While Sustainability communication caters many stakeholders, including customers and employees, ESG communication is mainly meant to engage investors.

This is an important message and a core need of the investors. Keeping this mind, a genuine ESG communication profile can certainly engage your investors and in the right manner.

Sustainability communication is a generic term to highlight a sustainability strategy of the company. It tells customers, consumers and other stakeholders that a company is committed to pursuing sustainable development and is moving towards a more sustainable transition. This role usually sits with the sustainability leadership or corporate social responsibility teams (CSR) within a company. And the primary stakeholders are end customers and investors.

The target audience for ESG (Environment, Social or Governance factors) communication is very much Investors. ESG is a not a common term used among the consumers but is largely driven by Institutional investors who regularly look for ESG Issues that a company may have. Investors assess ESG factors, specifically those which have a material impact on a company. This role is very largely “Investor relations” with a collaboration with corporate social responsibility teams and sustainability leadership. Financial teams certainly become a part of the conversation to identify the financial impact of sustainability or ESG initiatives undertaken by a company.

See how we can help you with your ESG communication profile.

ESG and sustainability works in tandem to deliver on business value so you can meet your investors' expectations and drive customer engagement.

Alignment with your Sustainability Strategy

A company’s sustainability strategy involves a thorough look into both the external environment and its own internal operational and strategic activities. Communication initiatives should be very much tied to the overarching goals as defined by a sustainability strategy. The most successful communications are the ones which tightly defines the target audiences and develop messages appropriate to them. Delivery channels then get carefully chosen to reach the audience as intended. The channels for delivery must have a measurable impact on the audience profiles, and where the results can be measured – this results in a huge value.

Utilizing traditional channels is good but we highly recommend moving beyond reporting and investing into digital channels for impact, measurement and outreach. Digital channels are measurable and can be quickly optimized as needed.

Reach out to us

Private equity firms are required to have an ESG strategy which is aligned to the limited partner’s ESG focus. Private equity industry is under greater scrutiny than ever before, and PE firms must do a better job of capturing and tracking the value they are creating and the impact of their activities.

SIOChain - Supply chain sustainability management system positions you stronger growth working closely with suppliers or partners to manage your environmental and social impact. Through supplier engagement, supplier recognition, and sustainable procurement, you can manage risks while increasing productivity and efficiency within the value chain

Our team provides services and due diligence to not only identify ESG opportunities but help our clients quantify potential ESG benefits and risks, incorporate ESG policies into the strategies and activities, facilitate transactions between asset buyers and sellers, and provide confidence among all parties that ESG commitments are made, and risks are managed.

It is very important that companies make sustainability and ESG a central component of their business model. “We know that climate risk is investment risk. But we also believe the climate transition presents a historic investment opportunity”, says Lary Fink from BlackRock. Authoritative statements like these present an opportunity for companies to prepare their business and our economy against the greatest global threats while it opens doors for capital access.

It is imperative to activate ESG and sustainability through the supply chain to develop transparency and visibility on ESG and sustainability practices. Companies need to collaborate with their suppliers and supply chain participants in upstream and downstream operations in order to meet their environmental and sustainability commitments. See more.

Effective communication with sustainable investors focused on your ESG progress is an important component of your ESG strategy. It fills the gap between investor expectations and your sustainability

or ESG strategy.Sustainability and ESG communication is an approach to engage your customers and

investors, and to showcase your ESG progress and sustainability commitments.

It is imperative to focus on supply chain sustainability in order to meet your sustainability commitments and meet your environmental targets. SIOChain™, a technology platform is designed to engage your suppliers and collaborate to measure, monitor and embed sustainability and ESG in your supply chain.

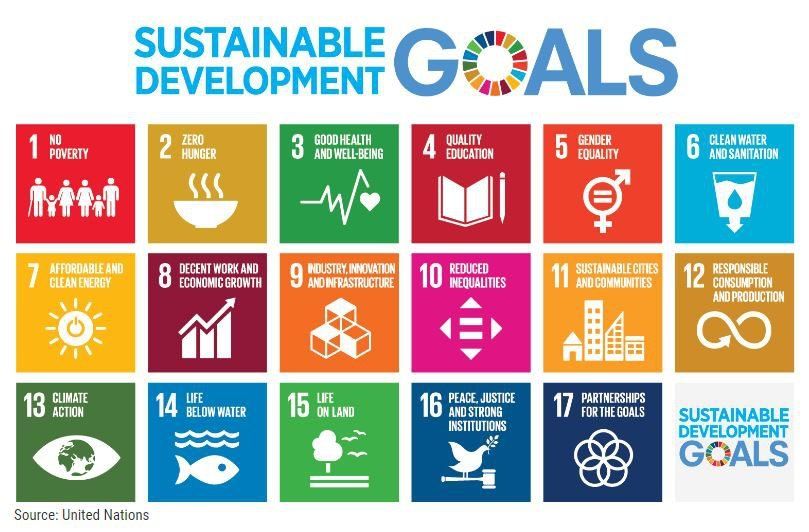

The purpose of sustainable financing, as stated by the UN Environment Programme , is to increase the level of financial flows (from banking, micro-credit, insurance and investment) from the public, private and not-for-profit sectors to sustainable development priorities. The aim is to align financial systems, working with countries, financial regulators and financial sectors, and direct capital allocation to sustainable development that will shape the production and consumption patterns of tomorrow. Financial mechanisms such as Green Bonds, Social Bonds and ESG Linked Loans help this alignment as they promote public-private partnerships for sustainable development. The Sustainable Development Goals (SDGs) are a collection of 17 global goals set by the United Nations General Assembly as an agenda for the year 2030. These 17 SDGs are an urgent call for action by developing and developed countries and provide a blueprint for the peace and prosperity for people and the planet. The SDGs also recognize issues related to the planet, such as biodiversity, and to people, such as poverty, and accept that solutions to address all of these issues are interconnected. Green Finance (or Sustainable Finance) instruments such as Green Bonds, and bonds focused on other thematic issues such as Social Bonds, Sustainability Bonds or Sustainable Development Goal Bonds, can act as a strong bridge to the SDGs. Such initiatives allow the flow of capital to execute and meet corporate sustainability commitments. They are also attractive to institutional investors as they perceive financial commitments to sustainability as a good indicator of a corporation's ESG progress. Related: More about Social Bonds