ESG - Integration strategy, sustainable finance and communication

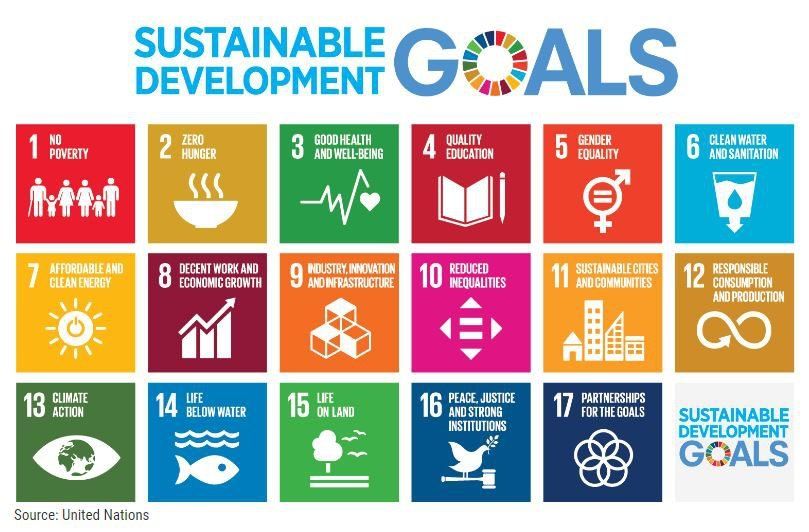

Communicating your strategy to ESG focused investors is a key component of ESG integration. With Environmental, Social and Governance (ESG) investing now a mainstream feature for investors - companies, issuers and banks are making changes to show ESG improvements and sustainable finance initiatives.

How does Sustainable Finance and ESG communication work together?

It is interesting to see that finance and sustainability cross paths while smiling at each other but are still unsure of the best way to interact. Companies should focus on creating connections and fluency between finance and sustainability functions within the corporate organization.

One of the ways is to communicate and create materials for easy distribution and access when a financial initiative is undertaken to fund sustainable projects within an organization. When initiatives such as a social bond issuance, as an example, are undertaken, the reasons of issuance, the projects being funded, or the use of proceeds can be creatively presented for internal alignment and to cater to inquiries by investors.

Why does this matter? Many companies (and in particular, CFOs) may not be aware of the importance of environmental and societal stewardship and how it affects investor decision-making — and ultimately reputation and stock price. Hence, communication of ESG improvements and sustainable finance becomes one of the key strategies to gain investor alignment.

Sustainable finance communications can help improve your ESG score. Connect with us to know more.

How does theSustainability.io (teamSIO) help you to target ESG investors?

We engage with corporates and banks on a number of fronts, on the investor relations side, on the treasury side and within our capital markets function.

On one side teamSIO manages programs to provide insights into volume flows and into the types of investors that are interested in your business, as well as gives you access to information around what institutions are thinking about and what they are interested in. On the other side, our team also creates digital and interactive ESG communication strategies and tactics to engage investors in your ESG and sustainability profile.

theSustainability.io view

With more investors actively integrating ESG into their decision-making, teamSIO Services continues to support clients on adherence to Green Bond Principles, Social Bond Principles and Sustainable Bond guidelines for sustainable investments, provide additional reporting on specific metrics and segregate capital and cash flows as required. For issuers, it means considering how to best incorporate ESG into their investor relations and financial stories. We actively work with both investors and issuers to understand their ESG priorities and help them achieve their objectives.

Reach out to us